charitable gift annuity tax reporting

Annual financial filing statements. A charitable lead trust pays an annuity or unitrust interest to a designated charity for a specified term of years the charitable term with the remainder ultimately distributed to non-charitable beneficiaries.

Gifts That Pay You Income Fred Hutchinson Cancer Research Center

Fixed payment policy survey explanation and instructions.

. 31 2004 Act 40 of July 7 2005 provides that income from a life insurance or endowment contract or annuities such as a charitable gift annuity or an annuity contract purchased as retirement annuity that is not from an employer sponsored retirement annuity or are not part of an employer sponsored program. From a fiscal perspective the tax breaks are a huge advantage to making a planned giving arrangement. The proper reporting of gifts on Form 709 depends on a number of factors including the type of gift who the gift is given to and whether the.

And Invests contributions made in exchange for charitable gift annuities solely in conformance with article 9 of RSA 564-B general standards of prudent investment. Charitable contributions to qualified tax-exempt organizations do not need to be disclosed on a gift tax return unless the taxpayer otherwise has a reporting requirement for other taxable gifts. A type of gift transaction in which a donor contributes assets to a charitable trust which pays an annuity designed to leave a substantial proportion of the.

Data calls and reporting. 78 data Organizations whose federal tax exemption was automatically. Employing staff Te tuku mahi ki ngā kaimahi.

Depending on your tax bracket the type of asset and the type of charity the charitable deduction can reduce your income taxes by 10 percent 20 percent 30 percent or even more. You may search for. Including a deduction for estate or gift tax purposes cannot have a total value of more than 60 of the total FMV of all amounts in the trust.

Charitable Remainder Annuity Trust. Independent review reporting for independent review organizations IROs. Independent review organization IRO process questions concerns and complaints.

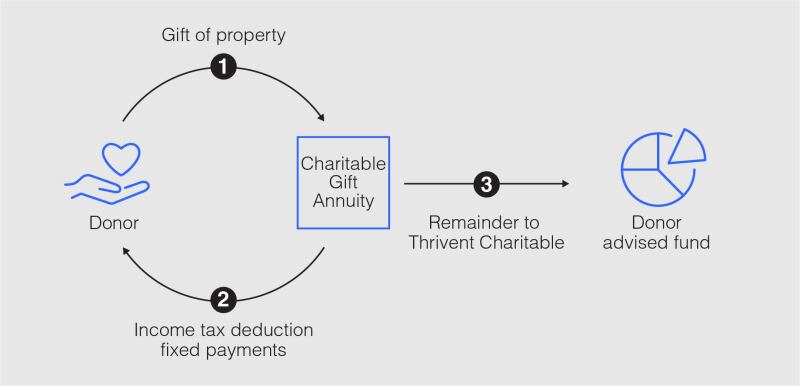

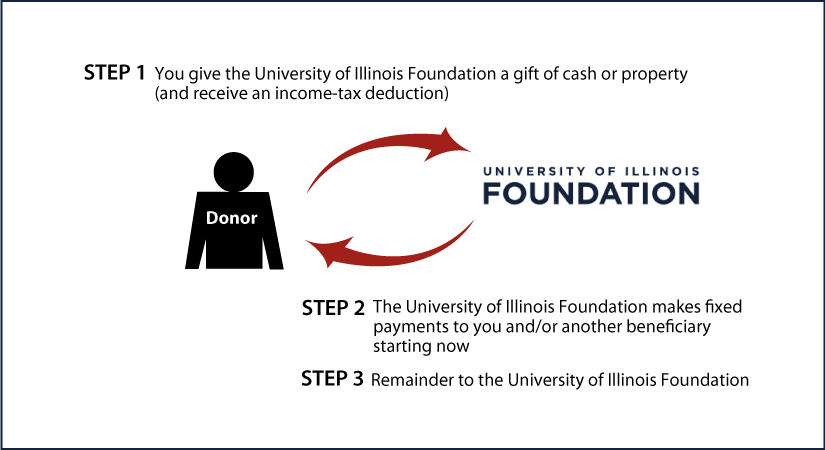

A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts or donations. Charitable gift annuity occurs when a donor makes an agreement with a nonprofit. For a sample form of a trust that meets the requirements of a testamentary charitable lead annuity trust see Rev.

Under the Coronavirus Aid Relief and Economic Security CARES Act you can deduct up to 100 percent of your charitable cash contributions to qualifying charities. For example in recent times crowdfunding campaigns have become a popular way to raise money for charitable causes. This article addresses various issues that may arise in the preparation of federal gift tax returns with a focus on gift tax returns that will be filed to report gifts made during 2009 or 2010.

Business and organisations Ngā pakihi me ngā whakahaere. Goods and services tax GST Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha. Captive insurer premium reporting and tax requirements.

However many of these crowdfunding websites are not run by DGRs. If in connection with a transfer to or for the use of an organization described in subsection c such organization incurs an obligation to pay a charitable gift annuity as defined in section 501m and such organization purchases any annuity contract to fund such obligation persons receiving payments under the charitable gift annuity. Charitable gift annuity increased by earnings on the contribution and decreased by annuity payments and expenses properly allocated to the annuity until the annuity is terminated.

For 2019 the annual exclusion for a gift of a present interest is 15000. KiwiSaver for employers Te KiwiSaver mō ngā kaituku mahi. A segregated balance of funds account for which the bank acts on behalf of the account holder.

Risk retention and purchasing groups. Charitable Trusts Charitable Lead Trust. For federal tax purposes this trust is treated as a grantor trust.

Not all charities are DGRs. Combined Federal Campaign or Campaign or CFC The charitable fund-raising program established under Executive Order Number 10728 as amended by Executive Order Number 10926 12353 and 12404. IRD numbers Ngā tau.

Such accounts operate under very strict guidelines as funds can only be accessed in. From the IRS Tax Exempt Organization Search is an on-line search tool that allows users to verify that an organization is tax exempt and check certain information about its federal tax status and filings. As with all annuity types indexed annuities are tax-deferred products.

Tracking planned giving data and reporting updates to board. When stocks in your index such as the SP 500 increase in value the value of your contract increases. The donor gives a large amount of money to the nonprofit.

For taxable years beginning after Dec. Special liability report instructions forms and historical data. Organizations eligible to receive tax-deductible contributions Pub.

Income tax Tāke moni whiwhi mō ngā pakihi. The added increase in yields may serve as a hedge against inflation. Independent review reporting for independent review organizations IROs Independent review reporting for carriers.

Charity Charitable Organization or Organization A private non-profit philanthropic human health and welfare organization.

Charitable Gift Annuities Development Alumni Relations

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Tax Advantages For Donor Advised Funds Nptrust

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Charitable Gift Annuities Natural Resources Defense Council

City Of Hope Planned Giving Annuity

How To Maximize Charitable Impact With Non Cash Assets

Non Cash Donations Archives Gordon Fischer Law Firm

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

Charitable Gift Annuity Claremont Mckenna College

Everything You Need To Know About A Charitable Gift Annuity Due

Life Income Plans University Of Maine Foundation

Consumer Report Gift Annuity Calculator

University Of Illinois Foundation Gift Planning Charitable Gift Annuity